how to calculate tax withholding for employee

The Tax Withholding Estimator works for most employees by helping them determine whether they. Change Your Withholding.

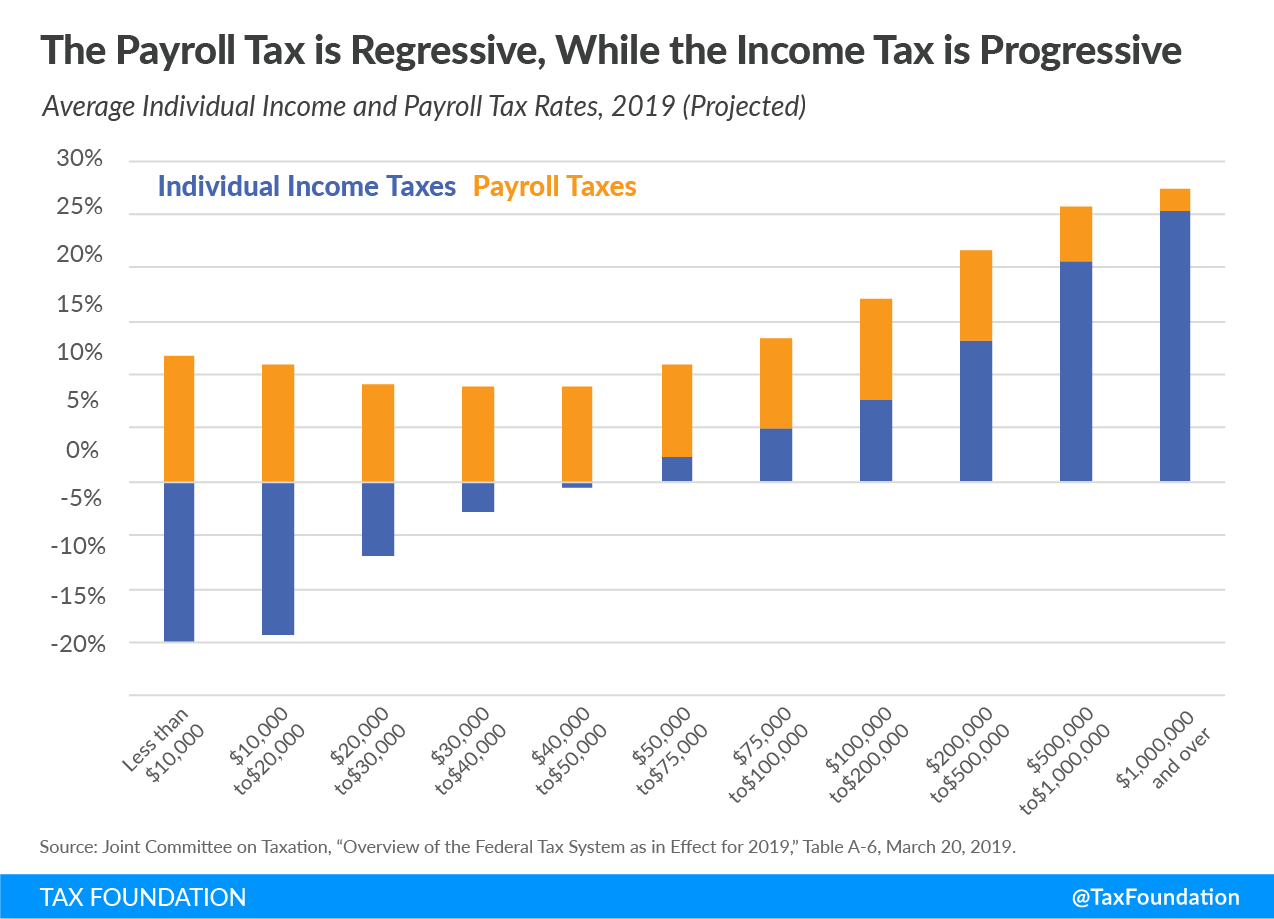

Most Americans Pay More In Payroll Taxes Than In Income Taxes

Use the Tax Withholding Estimator on IRSgov.

/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

. Similarly to how a business deducts tax from a regular salary a deduction is made from incentive pay too. To calculate withholding tax youll need. For employees withholding is the amount of federal income tax withheld from your paycheck.

Heres the good news. The employees adjusted gross pay for the pay period The employees W-4 form and A copy of the tax tables. Any additional withholding amounts requested on the Massachusetts Employees Withholding.

What is the withholding tax rate for 2021. Earnings Withholding Calculator. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer.

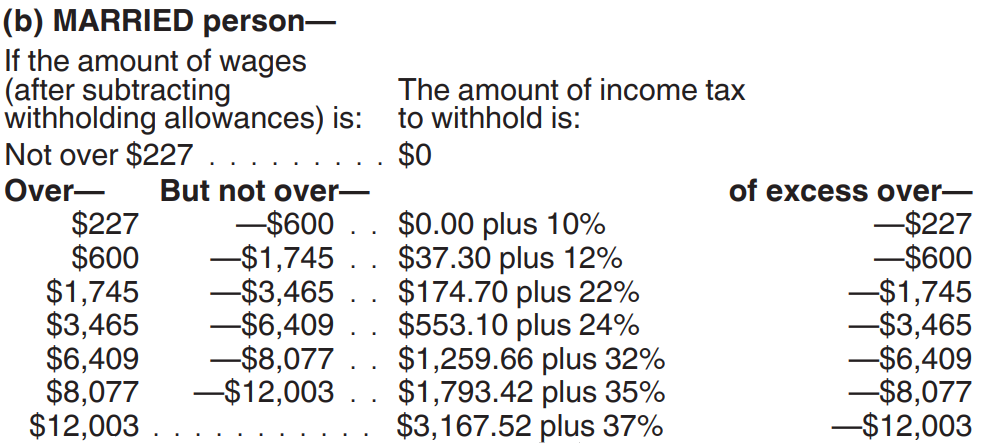

To calculate tax withholding amount employers determine the number of allowances employees claim on their IRS Form W-4 Employees Withholding Allowance. The federal withholding tax has seven rates for 2021. There are two main methods for determining an employees federal income tax withholding.

Alternatively you can use the range of tax. For withholding rates on bonuses and other compensation see the Employers Tax Guide. Step 2 - Gross Earnings.

10 12 22 24 32 35 and 37. To calculate Federal Income Tax withholding you will need. There are two main methods small businesses can use to calculate federal withholding tax.

The wage bracket method and the percentage method. Known as tax withholding this is sent to the IRS by the company on the employees. To use these income tax withholding.

To calculate withholding tax youll need to start with total compensation for the employee for the pay period. How to calculate withholding tax. How often is the employee paid.

Sign Up For Our Withholding Email List. Calculating amount to withhold. Step 3 - Withholdings.

The IRS income tax withholding contains instructions on how much to. Employers must file withholding returns whether or not there is withholding tax owed. Specify which version of Form W-4 applies to the employee before 2020 or after.

How to Use the Tax Withholding Assistant. Use this tool to. Complete a new Form W-4P.

Step 1 - Pay Period. Employers use Form W-4 and the IRS income tax withholding tables to calculate withholding tax. The Commonwealth deems the amounts withheld as payment in trust for the employees tax.

How to check withholding. Employees Gross Earnings. After youve determined that you can use.

The federal withholding tax rate an. The IRS provides a taxpayer guide for filling out your Form. Submitting Year End W2s 1099s and G-1003 Annual Return.

This is another reason an employee may want to re-calculate their withholding tax in the middle of a tax year. See how your refund take-home pay or tax due are affected by withholding amount. Use this calculator to help you complete Wisconsin Form WT-4 Employees Wisconsin Withholding Exemption CertificateNew Hire Reporting.

The amount of income tax your employer withholds from your regular pay. The number of exemptions claimed. The easiest and quickest way to work out how much tax to withhold is to use our online tax withheld calculator.

Estimate your federal income tax withholding. Select your withholding status and. The employees taxable wages.

Indicate how frequently you pay your employee.

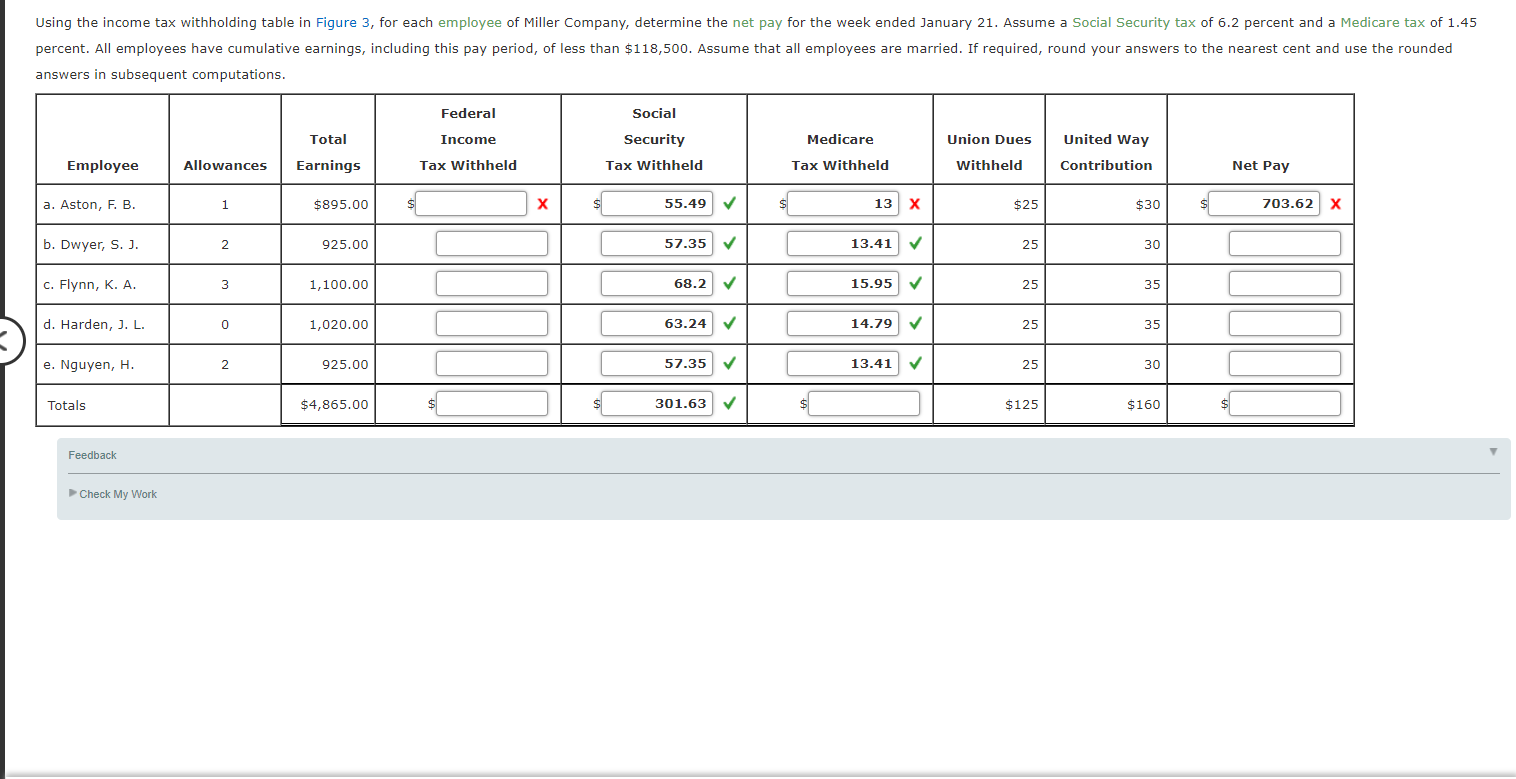

Using The Income Tax Withholding Table In Figure 3 Chegg Com

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How To Calculate Fica For 2020 Workest

.jpg)

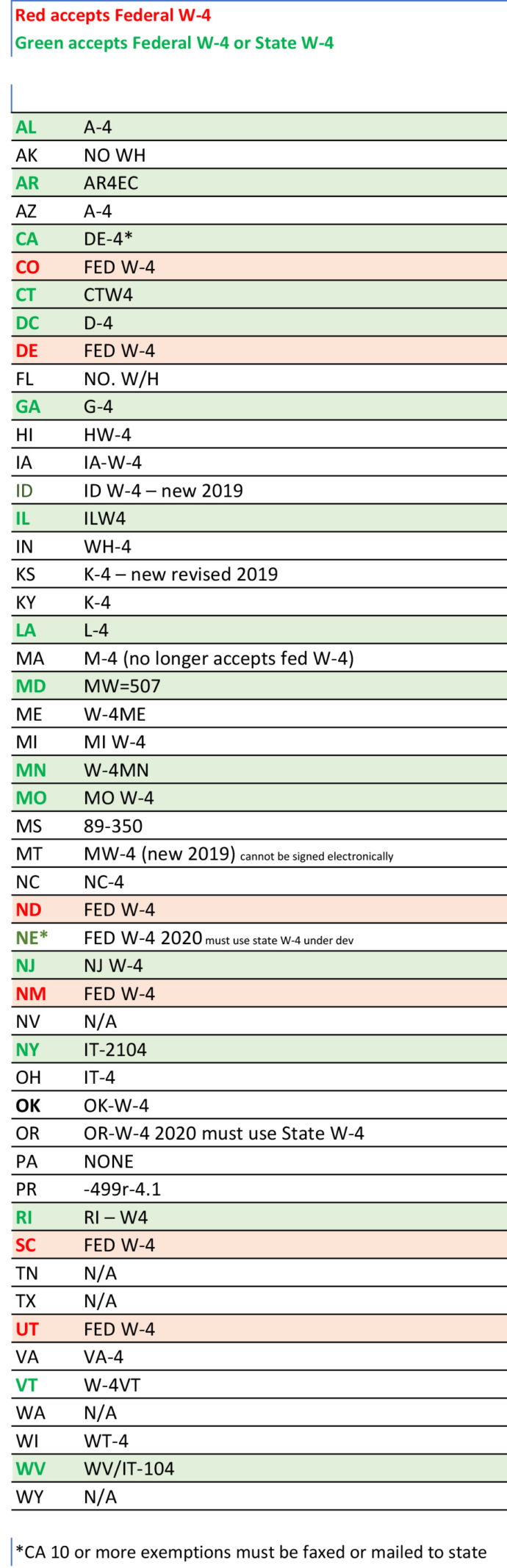

Az No State Withholding On Payroll Check Das

How Are Payroll Taxes Calculated Federal Income Tax Withholding Payroll Services

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Paycheck Calculator Take Home Pay Calculator

Calculation Of Federal Employment Taxes Payroll Services

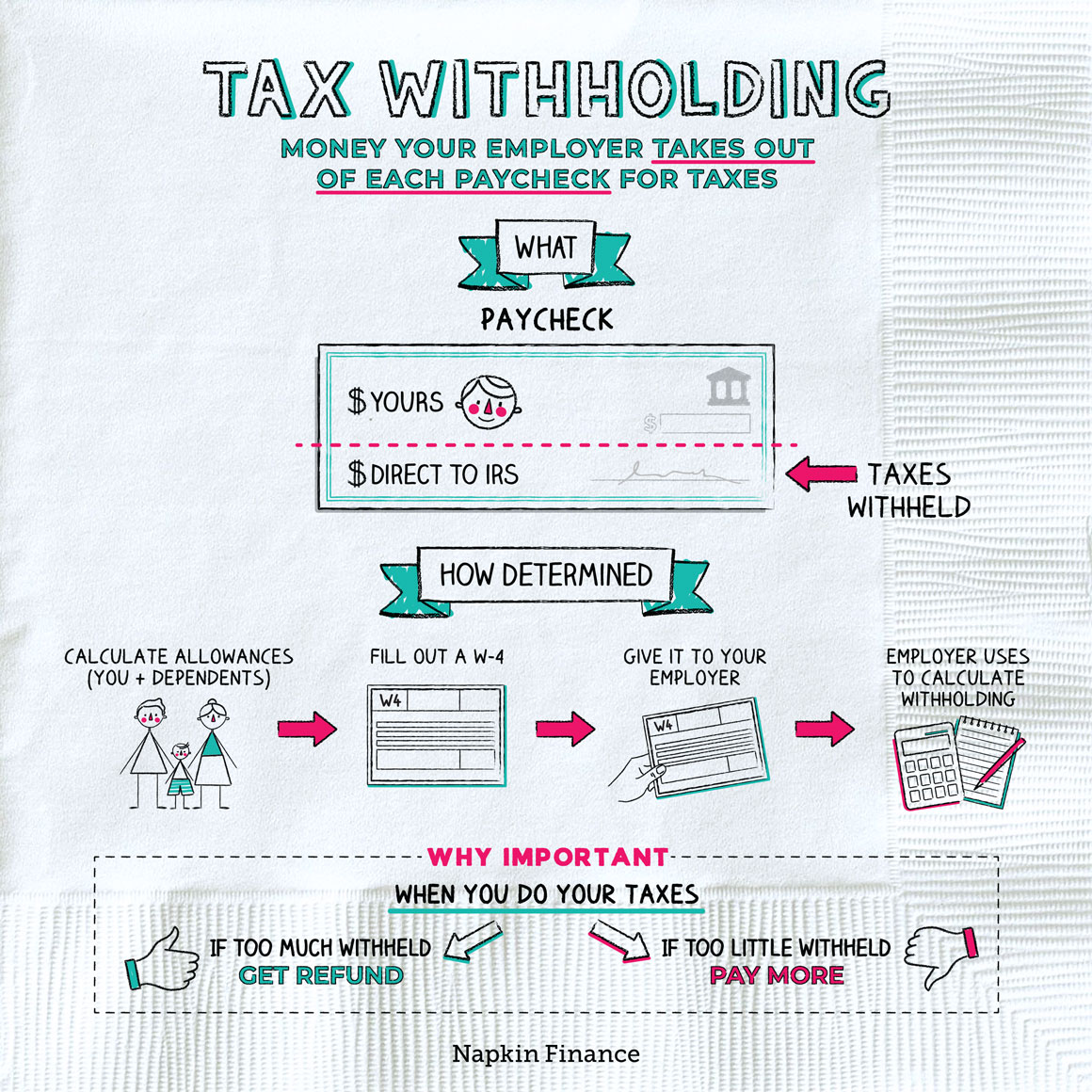

What Is Tax Withholding All Your Questions Answered By Napkin Finance

What Is Tax Withholding All Your Questions Answered By Napkin Finance

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Explaining Paychecks To Your Employees

How To Calculate Federal Tax Withholding 13 Steps With Pictures

Paycheck Calculator Take Home Pay Calculator

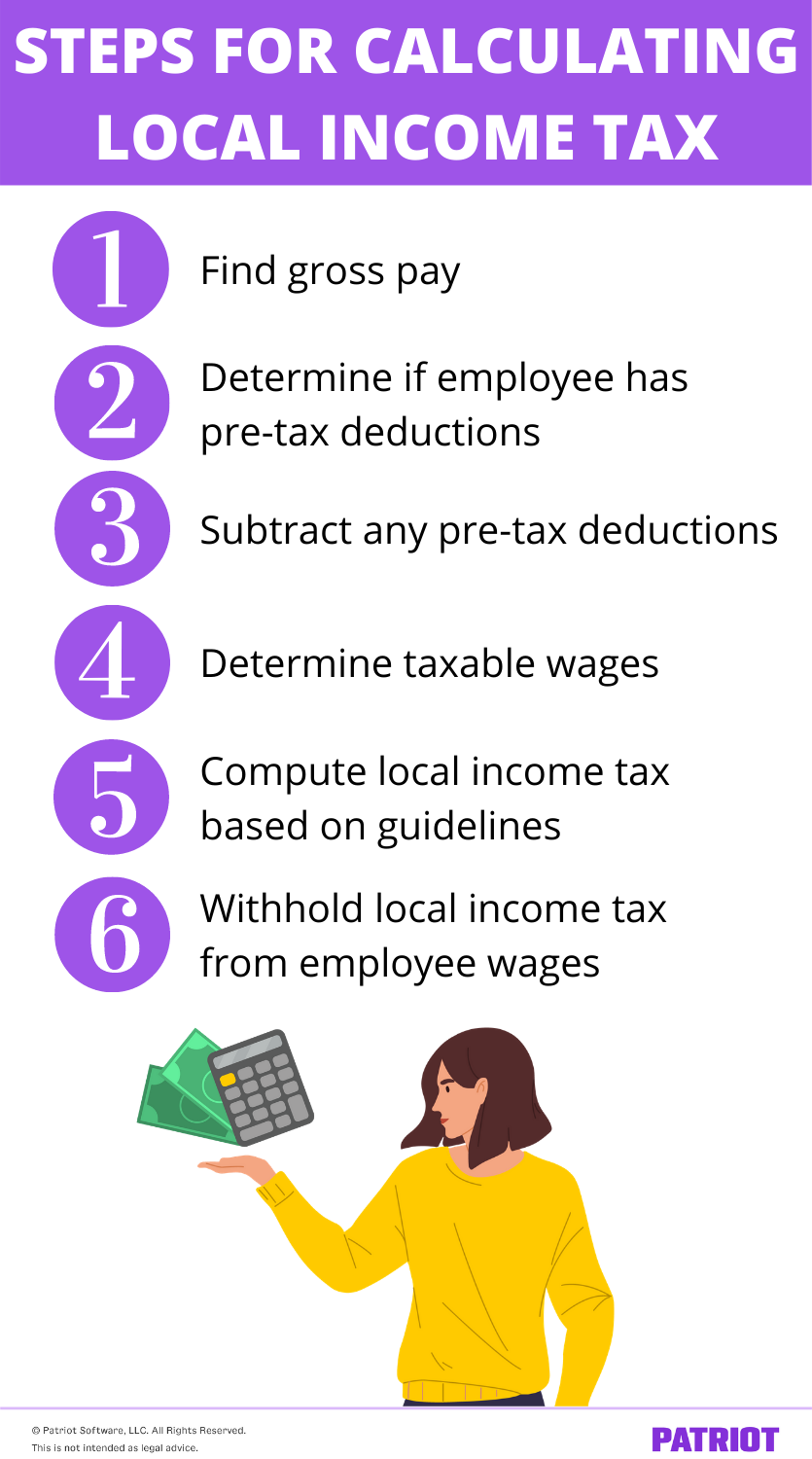

How To Calculate Local Income Tax Steps More

Payroll Tax What It Is How To Calculate It Bench Accounting

What Are Payroll Taxes An Employer S Guide Wrapbook

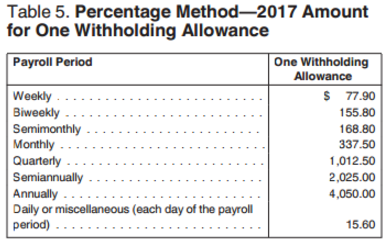

The Percentage Withholding Method How It Works Paytime Payroll